Tenant Insurance Toronto 101: Everything You Need to Know

If you are a tenantor and want to rent a place, whether it’s an apartment, condo, or townhouse, it’s best for you to consider having tenant insurance Toronto. Aside from the fact that it’ll help you protect your belongings, the peace of mind it’ll bring you is worth every penny.

Knowing your house goods and belongings are safe and protected and that you’ll have financial safety in case of unpredicted incidents allows you to enjoy living every second of your time at your property. Stick around to explore the nitty-gritty of renters insurance in Toronto.

What Is Tenant Insurance in Toronto?

Renters insurance Toronto, also known as tenant insurance, is a type of coverage that offers protection to tenants and their possessions. This is tailored for those renting a house, condos, or any other kind of property. It is different from home insurance, as it does not provide protection for the house itself.

On the flip side, the home insurance won’t cover damage to your belongings or anyone living in it. Additionally, they have the right to sue you if you were to blame for any damage caused in the building. You can benefit from tenant insurance Toronto in such circumstances.

What Are The Benefits of Having Renters Insurance in Toronto And Why Do You Need One?

Tenant insurance Toronto can help you cover the unintentional or accidental expenses coming your way. It’s not uncommon for landlords to require you to get this insurance as part of your contract. Typically, there are four types of coverage you can benefit from:

- Contents Insurance: Provides financial security for the harm made to your belongings, whether they are currently located at your house or not.

- Tenant Liability Insurance: You’ll be protected if someone is unexpectedly injured in your house or you’ve unintentionally impaired someone’s property. Under this coverage, your insurer will take care of your legal defense fees and damage reimbursements if you’re found guilty.

- Replacement Cost: Your damaged goods will be restored to their initial condition or replaced with brand-new products of the same quality caliber.

- Additional Living Expense Coverage: This will assist you in paying for additional costs like food and hotel when your house is not habitable due to damages.

Despite the high cost of living in Toronto, tenant insurance is not an expense you should overlook. Approximately half of Ontario renters live in the Toronto metropolitan area, making it a big market for tenant insurance.

Having a good tenant insurance policy in Toronto is vital for taking care of your house goods and your financial security in case of unanticipated accidents like fire or theft.

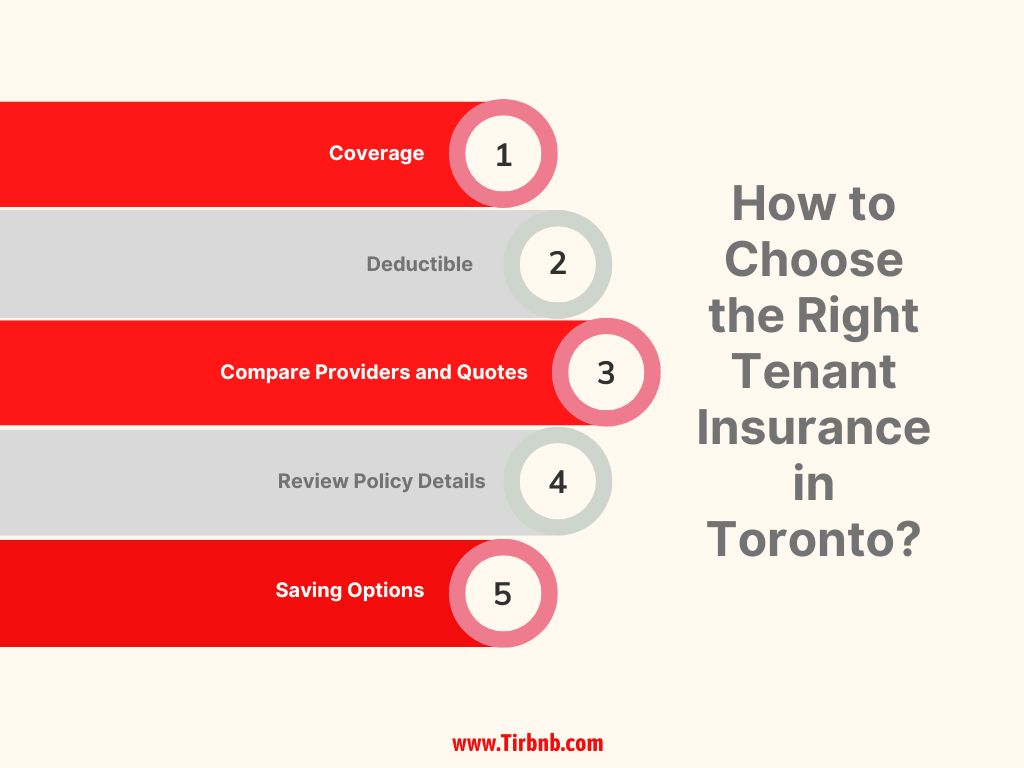

How to Choose The Right Tenant Insurance in Toronto?

Choosing the right tenant insurance in Toronto is as crucial as any other part of the process. Moreover, there are some factors to consider when picking one:

- Coverage: When going through your tenant insurance, ensure it offers the protection you’re looking for. A policy is expected to include personal belongings and liability protection, but you might want extra coverage for matters like identity theft or valuable things. You can also ask for coverage on particular hazards like earthquakes or floods. Additionally, if you work from home, you can add a home business rider to expand your coverage.

- Deductible: This is a big factor to consider as it directly affects your tenant insurance. To select an amount that is suitable for your situation, consider what you can afford and pay out of your own pocket for any given renovation.

- Compare Providers and Quotes: Get access to different insurance companies in Toronto and compare their prices and coverage options.

- Review Policy Details: Go through the policy details thoroughly and review the covered perils, limitations, and exclusions. Make sure it includes liability coverage for legal and medical emergencies in your residence.

- Saving Options: Search for discounts and saving opportunities.

What Is Not Covered Under Toronto Tenant Insurances?

Not everything’s going to be covered by tenant insurance policy. There are situations where you have to pay out of your pocket. Here’s a list of some of the common ones:

- Molds

- Unit’s wear and tear

- Damages caused by animals or insects

- Harms done by leaving the property unmonitored

- War damage

- Illegal activity damages

- Nuclear incident byproducts

It’s worth noting that if you leave your house uninhabited for more than 30 days in a row, you will not have insurance protection. Also, if you don’t include sewer backup, flooding, or earthquake protection, you will not be covered if those are the damaging causes.

How Much Does It Cost?

The cost of tenant insurance in Toronto varies from roughly $200 to $500 annually or $10 to $50 monthly.

Multiple factors determine the price of renters insurance policy:

- Your credit score

- Your insurance and claims record

- The sum total of your items’ value

- The recurrence of natural catastrophes in your area

- Your area’s crime rate

- Closeness to risky environments like rivers

- Discounts and their eligibility

- Policy options

Top Tenant Insurance Choices in Toronto

Toronto renters have many well-known insurance firms to pick from. Here are some of the best tenant insurance Toronto companies:

1. TD Insurance

This firm provides holistic tenant insurance policies, great plans, and modifiable coverage options. The estimated monthly premium for TD Insurance is $40.33.

2. RBC Insurance

RBC Insurance offers renters insurance policies covering liability, personal belongings, and extra living costs. Additionally, they provide optional coverage for identity theft, overland water, and sewer backup. The monthly premium for this company is roughly $40.59.

3. CIBC Insurance

CIBC also provides standard coverage options. On top of that, they have policies featuring inflation-related adjustments, additional living expenses, and voluntary payments for residence employees. You’ll have to pay an estimated $46.67 monthly premium with this company.

4. Sonnet Insurance

Sonnet is an insurance provider operating on a fully digital basis, allowing customers to customize their coverage options completely. They have all the standard coverages plus many additional services. The fee for their monthly premium sits at about $41.76.

Is Renters Insurance Toronto Different from Short Term Rental Insurance?

Renters insurance Toronto is for individuals who rent their primary residence on a long-term basis. It protects tenants’ personal belongings and offers liability coverage within their rented living space.

Short term rental insurance, on the other hand, is designed for property owners who rent out their homes or secondary properties for brief periods of time, often less than 30 days. Therefore, it goes to short-term rentals in Toronto.

It usually includes coverage for property damage caused by guests, liability for guest injuries, and loss of rental income due to property damage or other covered incidents.

Conclusion

Insuring your material belongings and home goods is of the utmost importance. The more comprehensive your tenant insurance Toronto is, the less you need to worry about your possessions. Ultimately, you have the option to choose from different companies with different services, so pick the one that suits your needs best.

FAQs

1. How Much Is Tenant Insurance in Toronto?

If we want to be exact and focus on the majority of the tenant insurance available in Toronto, the average cost fluctuates between $20 to $35 per month. That is to rule out the outliers, the extremely cheap ones, and the very expensive ones. If taken into account, the price ranges from $10 to $50.

2. Is Renters Insurance Toronto Mandatory?

Tenant insurance is not legally mandatory in Toronto. Thus, there’s no provincial law mandating tenants to get insurance coverage. However, Ontario standard lease is mandatory and you should not forget to sign one.

3. Are There Any Circumstances in Which a Landlord Would Deny an Application from a Potential Tenant Who Does Not Have Renter’s Insurance?

While it’s not as widespread as it can be, there’s been an increase in the number of landlords requiring tenants to have tenant insurance. Therefore, the chances of getting rejected by landlords are getting higher as they recognize the benefits it can have for them and their property.